“The(7th Day) Sabbath in the True Orthodox Church” (East and West)

NOTICE FOR NON-BELIEVERS – You Are On A Private Website For Fully Converted Christians

HOMEPAGE FOREWORD: You won’t hear the promotion of abominations and blasphemies from our church. “These days” some people say that our Orthodox beliefs will scatter the flock. Manmade traditions might do that, […]

1945 last Confederate Stronghold, Secession & Reunion Monument

The Life and Works of St Aengus (the Culdee) Hagiographus

The Forgive and Forget Command, for healthy Christian related relationships

Dr Stephen M.K. Brunswick Dept. of Theology, Priory of Salem Forgive and forget, truly. Lord’s Prayer: “forgive us our sins as we forgive others”. Do you want God to keep […]

The Adverse Influence of Pork Consumption on Health by Dr Reckeweg M.D.

The World Conquerors, the real war criminals by Louis Marschalko PDF download

“Old Races” or Pre-Adamites, the Most Scientific, Biblical and Respectful Theory for all Races

Culdee / Spouses of God Prophecy: Céilí Dé meaning Spouse of God

Céilí Dé or Céli Dé means “spouse of God” or “companion of God” in ancient Celtic / Irish. Jowett maintained in his book “Drama of the Lost Disciples” that for […]

A Few “Separatist Culdee” Books on 2nd Century St Elfanus and his King Lucius

1st Century Irish Druids Incorporated Hebrew Christianity at Glastonbury Under Direction of the King of Ulster

In the 1922 Cambridge printed book titled, “St. Joseph at Arimathea at Glastonbury” written by the Vicar of Glastonbury, Reverend Smithett Lewis, it says that as early as 48 AD […]

WAR AND THE BREED by David Starr Jordan – PS, Institute of Peace Studies

Spiritual, Biblical and Scientific Reasons of Clean and Unclean Meats

Teachings by Pastor Crouch, on Clean and Unclean Within the sub-teaching of the Power of Life or Death is in the Tongue we had to get into the topic of […]

St Elfan Avalonius, 2nd Century Welsh Saint, comm. January 1st and Sept 26

Potential Orthodox Blessings for Repentant Sinners (as the Latin Pope would agree?)

Open letter to ministers of the Gospel: I feel led of the Lord Jesus Christ to share this bit of admonishment with you to continue on the great work of […]

Bonus Book: “Anglo-Israel: or The British nation the lost tribes of Israel.”

The Spirit of Lilith, Pre-Adamic Demons, and Worldly Psychiatry **mp3**

Tracing Our Ancestors (British Israel book of the month)

Amra Of St Columba – 6th Century Poem on Life of Columba, an Early Culdee Church Father

CREATION… or CHANCE! God’s purpose with mankind proved by the wonder of the universe

New Testament Sabbath Blessings and Admonitions

A quick rundown of reasons the New Testament church is admonished to participate in the wonderful Sabbath blessings. Please see the content at the bottom of this article, listing Scriptures […]

State Monuments now being destroyed by church networks!

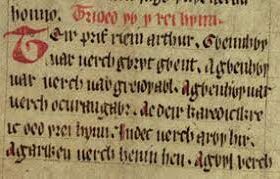

Triads of Wales – OCC E-Book Library Content

On Culdees Implementing the Rule of Chrodegang

Another example of the local independent nature of the Culdees institutions, was shown in their various implementations of the Rule of Chrodegang. Below is a review of the rules themselves. […]

Some inconvenient news you may have missed 10/26/2023

Daily Nationalistic News For Christian Europeans main feed page: https://www.watchman.news/daily-nationalistic-news-christian-european/ With the MILLIONS upon Millions of Muslim Jihadists in WESTERN CHRISTIAN COUNTRIES marching in support of Hamas at our capitals, […]

King Gregor, Founder of the MacGregor’s Clan, Protector of the Culdees

The Cele Dei Litany from Dunkeld

The Cele Dei Litany from Dunkeld translated by Peter Farrington A litany used at the ancient monastery of Dunkeld, which was accustomed to be sung together at public processions of […]